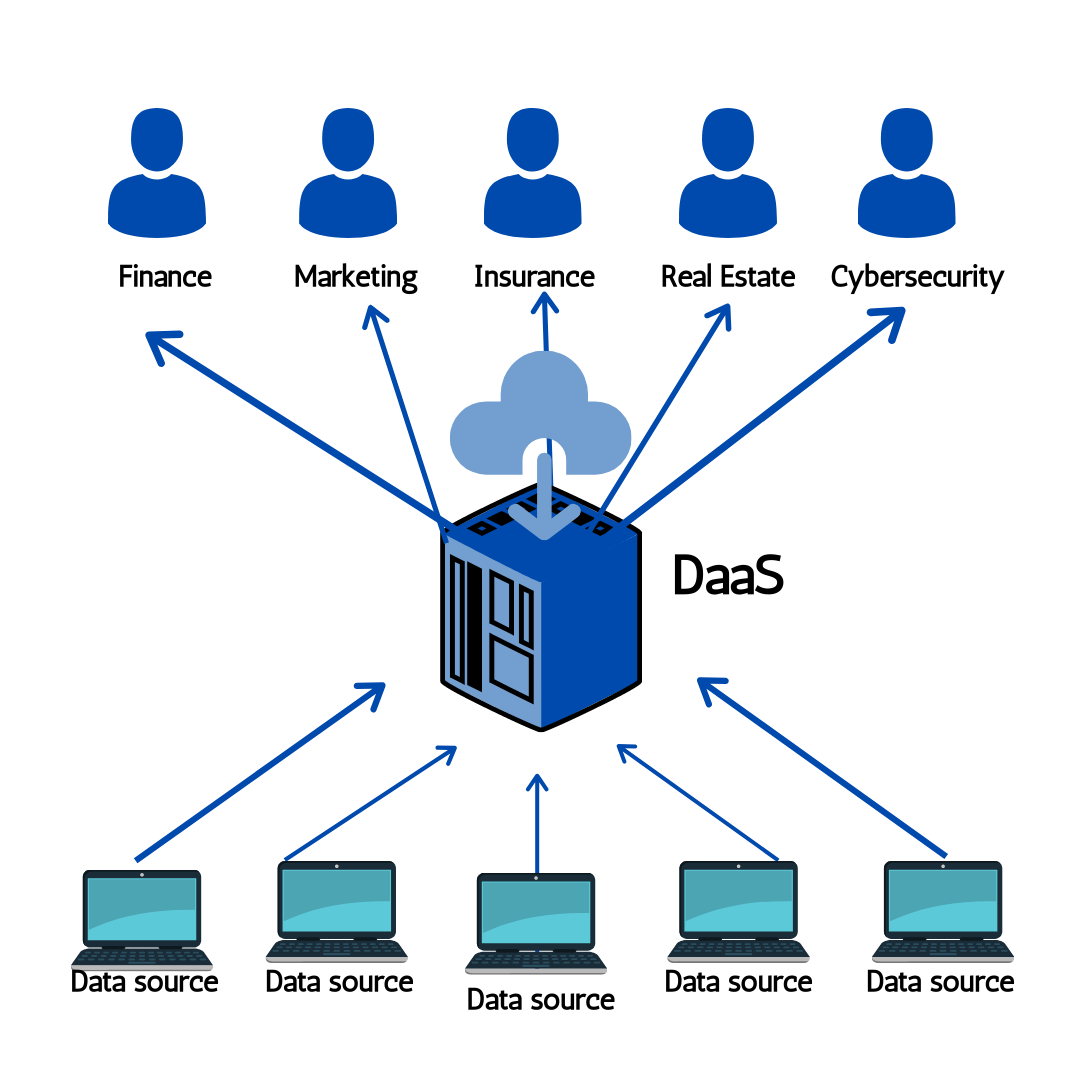

A rigorous Data as a Service (DaaS) Competitive Analysis reveals a fascinating and multi-layered competitive landscape where different types of companies compete on vastly different grounds. It is not a simple battle of who has the "most" data, but a sophisticated rivalry based on the uniqueness of the data, the quality of the insights derived, and the ease of consumption. The first major competitive front is the enduring rivalry between the traditional, authoritative data brokers and the new generation of alternative data providers. The incumbents, like Dun & Bradstreet in the business data space, compete on the basis of trust, brand reputation, and the sheer historical depth and perceived accuracy of their proprietary datasets. Their competitive moat is the fact that their data is deeply embedded as the "system of record" in the core operational workflows of thousands of global enterprises. In contrast, the alternative data providers compete on the basis of uniqueness and "alpha." Their value proposition is not authority, but an informational edge. They compete by finding and selling predictive signals that no one else has, making them indispensable to the quantitative hedge funds and sophisticated corporate strategy teams that are their primary customers.

The second major competitive front is the battle between the data providers themselves and the cloud data marketplace platforms that are becoming their primary distribution channel. This is a classic "platform vs. supplier" dynamic. The cloud marketplace platforms, like Snowflake Marketplace, are not data owners, but they are capturing an immense amount of value by controlling the point of consumption. Their competitive advantage is the powerful network effect of their two-sided market and the radical simplicity of their data sharing technology. They are competing to become the "Amazon for data." This puts them in a position of significant power relative to the individual data providers. A data provider almost has to be listed on these major marketplaces to reach the modern enterprise customer, which gives the platform provider significant leverage. This competition is about who owns the customer relationship and who controls the distribution channel in the new cloud-based data economy.

A third and equally important basis of competition is the quality and sophistication of a provider's technology stack. In the DaaS market, the raw data is often only the starting point. The real value is created in the processing, cleaning, enrichment, and delivery of that data. Therefore, a competitive analysis must scrutinize a company's data engineering and data science capabilities. How sophisticated are their AI/ML models for extracting signals from unstructured data? How robust are their data quality and data lineage frameworks? How reliable, scalable, and easy to use are their APIs? A company with a superior technology stack can produce a higher-quality data product from the same raw source material and can deliver it more effectively to its customers. The competition is therefore not just a battle over data sources, but a fierce technological competition to build the most efficient and intelligent "data refinery." The Data as a Service (DaaS) Market size is projected to grow to USD 75.2 Billion by 2035, exhibiting a CAGR of 17.23% during the forecast period 2025-2035.

Top Trending Reports -

Japan Messaging Security Market