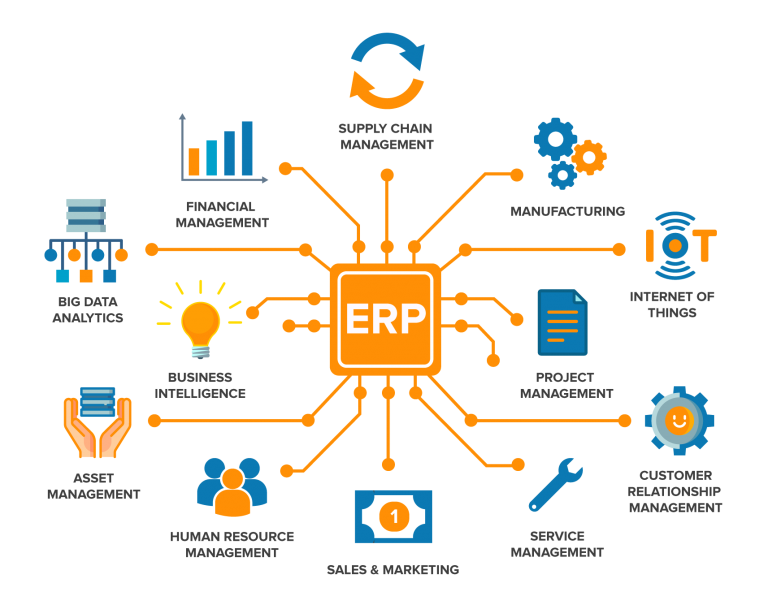

The competitive landscape that shapes the Enterprise Software Market Share is a fascinating and high-stakes arena, characterized by a dynamic tension between deeply entrenched, decades-old behemoths and a relentless wave of agile, cloud-native disruptors. This is not a market of perfect competition but a complex tapestry of near-monopolies in certain niches, fierce oligopolistic rivalries in major categories, and a vibrant, long tail of specialized innovators. A significant portion of the global market share is consolidated among a handful of legendary technology giants. Companies like Microsoft, Oracle, and SAP have built formidable empires and command a massive slice of the enterprise IT budget. Their dominance is rooted in their comprehensive, end-to-end product suites (e.g., Oracle's Fusion Cloud, SAP's S/4HANA), their deep industry expertise cultivated over decades, and the extremely high switching costs for their customers. For a large corporation, ripping out a mission-critical ERP or database system is an immensely complex, risky, and expensive proposition, creating a powerful "vendor lock-in" effect that serves as a deep competitive moat, allowing these incumbents to defend their substantial market share and maintain their influence over the industry's direction.

Despite this concentration of power at the top, the market share is far from static and is being continuously and profoundly reshaped by the most powerful disruptive force in modern technology: the shift to the cloud. This paradigm shift has enabled two new classes of players to seize a massive and rapidly growing share of the market. The first are the pure-play, Software-as-a-Service (SaaS) pioneers. Companies like Salesforce (which redefined the CRM market), Workday (in HCM and Financials), and ServiceNow (in IT Service Management) were born in the cloud. They have successfully captured a huge share of the market from legacy on-premises vendors by offering solutions that are typically more user-friendly, faster to deploy, and based on a more flexible subscription model. The second, and arguably more powerful, disruptive force is the rise of the cloud hyperscalers: Amazon (AWS), Microsoft (Azure), and Google (Google Cloud). These companies are no longer just infrastructure providers; they are major software players in their own right. They are aggressively moving up the stack, offering their own powerful databases, analytics tools, AI/ML platforms, and even business applications that compete directly with traditional enterprise software vendors, capturing an ever-increasing share of the overall enterprise IT spend.

The distribution of market share is further nuanced and fragmented by the powerful and pervasive influence of the open-source software movement and the rise of specialized, best-of-breed solutions. While it doesn't always appear in direct revenue-based market share figures, open-source software holds a commanding position in the foundational layers of the enterprise stack. The Linux operating system is the de facto standard for servers in the cloud, and open-source databases like PostgreSQL and technologies like Kubernetes are central to modern application development. This has created a massive market share for companies like Red Hat (an IBM company) and others who provide commercially supported, enterprise-grade versions of these open-source projects. Below the top tier, the market is highly fragmented with thousands of specialized vendors who focus on doing one thing exceptionally well, from cybersecurity to project management. The growing trend of the "composable enterprise," where businesses build a flexible tech stack using open APIs, is empowering these best-of-breed players. This results in a complex global market share: a top layer of legacy giants attempting to transition to the cloud, a powerful and growing layer of cloud hyperscalers and SaaS leaders, and a vibrant, dynamic base of specialized vendors and open-source ecosystems, all fiercely competing for their slice of the digital enterprise.